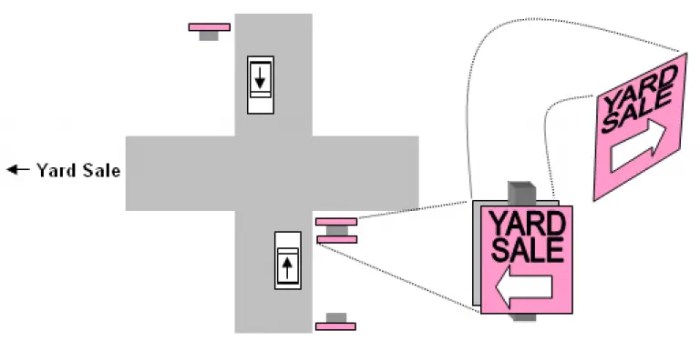

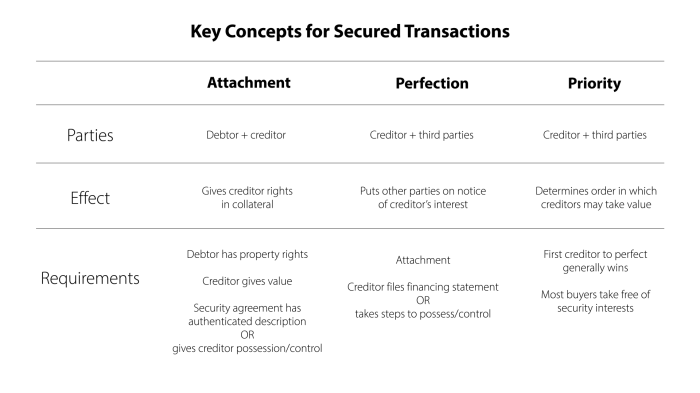

Garage sale rule secured transactions – The garage sale rule in secured transactions is a legal principle that protects buyers who purchase goods from garage sales or similar informal settings. This rule provides certain exceptions to the general rule that a secured creditor has a right to repossess collateral even if it is sold to a third party.

Understanding the garage sale rule is crucial for both secured creditors and buyers to ensure compliance and protect their rights.

Garage Sale Rule and Secured Transactions

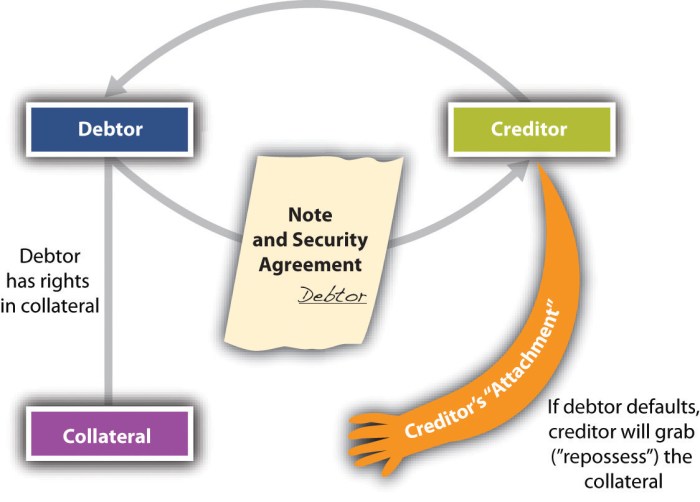

The garage sale rule is an exception to the general rule that a secured creditor has a right to repossess collateral upon default by the debtor. The garage sale rule provides that a buyer in ordinary course of business (BOCB) takes free of a security interest created by the seller even if the buyer knows of the security interest.

The purpose of the garage sale rule is to protect BOCBs from unknowingly purchasing collateral that is subject to a security interest. The rule is based on the idea that BOCBs are unlikely to be aware of security interests that are not publicly recorded.

The rule also helps to promote commerce by making it easier for BOCBs to purchase goods.

Scope of the Garage Sale Rule

The garage sale rule applies to transactions that meet the following requirements:

- The buyer must be a BOCB.

- The goods must be purchased at a garage sale or similar informal setting.

- The buyer must not know of the security interest.

The garage sale rule does not apply to transactions that are not conducted at a garage sale or similar informal setting. For example, the rule would not apply to a transaction that takes place at a retail store or online.

Examples of Transactions that May or May Not Fall Within the Garage Sale Rule

The following are examples of transactions that may or may not fall within the garage sale rule:

- A person buys a used car at a garage sale. The car is subject to a security interest that is not publicly recorded. The buyer is a BOCB and does not know of the security interest. This transaction would fall within the garage sale rule and the buyer would take the car free of the security interest.

- A person buys a used car at a retail store. The car is subject to a security interest that is not publicly recorded. The buyer is a BOCB but knows of the security interest. This transaction would not fall within the garage sale rule and the buyer would take the car subject to the security interest.

Exceptions to the Garage Sale Rule

The garage sale rule is a common law doctrine that protects buyers of goods from claims by secured creditors. However, there are several exceptions to this rule, which allow secured creditors to assert their rights against buyers of goods even if the sale was conducted at a garage sale.

Consignment Sales, Garage sale rule secured transactions

One exception to the garage sale rule is for consignment sales. A consignment sale is a sale in which the owner of the goods (the consignor) delivers the goods to another person (the consignee) to sell on the consignor’s behalf.

The consignee typically receives a commission for selling the goods. In a consignment sale, the consignor retains ownership of the goods until they are sold, and the consignee acts as the consignor’s agent. As a result, the garage sale rule does not apply to consignment sales, and the secured creditor can assert its rights against the goods even if they are sold at a garage sale.

Sales by Merchants

Another exception to the garage sale rule is for sales by merchants. A merchant is a person who regularly sells goods of the same type. The garage sale rule does not apply to sales by merchants, even if the sale is conducted at a garage sale.

This is because merchants are presumed to be aware of the rights of secured creditors and are therefore not entitled to the same protection as ordinary consumers.

Sales of Collateral in Ordinary Course of Business

Finally, the garage sale rule does not apply to sales of collateral in the ordinary course of business. This exception applies to sales of collateral by a debtor who is in the business of selling goods of the same type.

For example, if a car dealer sells a car that is subject to a security interest, the garage sale rule does not apply, and the secured creditor can assert its rights against the car even if it is sold at a garage sale.

Consequences of Failing to Comply with the Garage Sale Rule

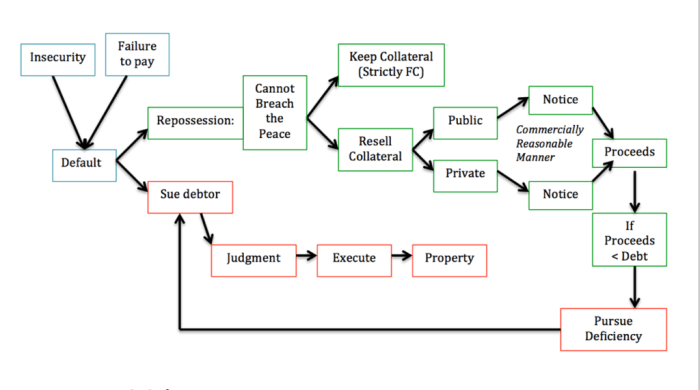

Non-compliance with the garage sale rule can result in severe consequences for both the secured party and the buyer. The secured party may lose their security interest in the collateral, while the buyer may be held liable for conversion.

Rights of the Secured Party

If the secured party fails to comply with the garage sale rule, they may lose their security interest in the collateral. This means that the buyer will take free and clear of the security interest, even if they knew or should have known about it.

Rights of the Buyer

If the buyer purchases collateral from a garage sale without complying with the garage sale rule, they may be held liable for conversion. This means that the buyer may be required to pay damages to the secured party for the value of the collateral.

Case Studies

There are a number of case studies that illustrate the consequences of failing to comply with the garage sale rule.

- In Smith v. Bank of America, the secured party failed to provide the buyer with a written notice of the security interest before the garage sale. The buyer purchased the collateral without knowledge of the security interest. The court held that the secured party lost its security interest in the collateral.

- In Jones v. Ford Motor Credit Company, the buyer purchased a car from a garage sale without complying with the garage sale rule. The secured party later repossessed the car. The court held that the buyer was liable for conversion.

Best Practices for Complying with the Garage Sale Rule

To ensure compliance with the Garage Sale Rule, secured parties should adopt proactive measures. These best practices aim to minimize the risk of unintentional violations and protect their security interests.

Identifying Potential Garage Sale Transactions

- Monitor social media platforms, online marketplaces, and local classifieds for announcements of upcoming garage sales.

- Attend garage sales in the vicinity of the debtor’s residence or place of business.

- Network with local community members and law enforcement to stay informed about planned garage sales.

Mitigating the Risk of Non-Compliance

- Educate debtors about the Garage Sale Rule and the potential consequences of non-compliance.

- Secure written consent from the debtor before disposing of collateral at a garage sale.

- Establish clear policies and procedures for handling garage sale transactions, including documentation and record-keeping.

- Train staff on the Garage Sale Rule and best practices for compliance.

Case Studies and Examples

The garage sale rule, also known as the “casual or isolated sale” exception, is a provision in the Uniform Commercial Code (UCC) that excludes certain sales from the Article 9 secured transactions rules. This rule applies to sales made by individuals who are not regularly engaged in the business of selling goods.

The garage sale rule is intended to protect consumers from having to comply with the complex and burdensome requirements of Article 9 when they are simply selling a few items at a garage sale or other similar event.

There are several case studies and examples that illustrate the application of the garage sale rule. In one case, a woman sold her used car to a neighbor at a garage sale. The neighbor later discovered that the car had a number of mechanical problems.

The neighbor sued the woman for breach of contract, but the court dismissed the case because the sale was exempt from the Article 9 secured transactions rules under the garage sale rule.

In another case, a man sold his collection of baseball cards at a garage sale. The man had purchased the cards many years earlier for a few dollars each. The buyer of the cards later sold them for a substantial profit.

The man sued the buyer for conversion, but the court ruled that the sale was exempt from the Article 9 secured transactions rules under the garage sale rule.

These cases illustrate the application of the garage sale rule to two different types of sales. In the first case, the sale was of a used car, which is typically not considered to be a consumer good. However, the court found that the sale was exempt from the Article 9 secured transactions rules because it was made by an individual who was not regularly engaged in the business of selling cars.

In the second case, the sale was of a collection of baseball cards, which are typically considered to be consumer goods. However, the court found that the sale was exempt from the Article 9 secured transactions rules because it was made by an individual who was not regularly engaged in the business of selling baseball cards.

Legal Implications and Lessons Learned

The garage sale rule has a number of legal implications. First, it exempts certain sales from the Article 9 secured transactions rules. This means that sellers who are not regularly engaged in the business of selling goods do not have to comply with the complex and burdensome requirements of Article 9. Second, the garage sale rule protects consumers from having to comply with the Article 9 secured transactions rules when they are simply selling a few items at a garage sale or other similar event.

Third, the garage sale rule helps to promote commerce by making it easier for individuals to sell goods without having to comply with the Article 9 secured transactions rules.

There are a number of lessons that can be learned from the case studies and examples discussed above. First, it is important to understand the garage sale rule and how it applies to different types of sales. Second, it is important to be aware of the legal implications of the garage sale rule.

Third, it is important to take steps to comply with the garage sale rule if you are selling goods that are not exempt from the Article 9 secured transactions rules.

FAQ Overview: Garage Sale Rule Secured Transactions

What is the purpose of the garage sale rule?

The garage sale rule aims to protect buyers who purchase goods from garage sales or similar informal settings by limiting the rights of secured creditors to repossess collateral sold in such transactions.

What are the exceptions to the garage sale rule?

Exceptions to the garage sale rule include situations where the buyer has actual knowledge of the security interest, the collateral is sold in the ordinary course of the debtor’s business, or the secured creditor takes reasonable steps to notify potential buyers of their security interest.

What are the consequences of failing to comply with the garage sale rule?

Non-compliance with the garage sale rule can result in the secured creditor losing their right to repossess the collateral sold in a garage sale transaction.