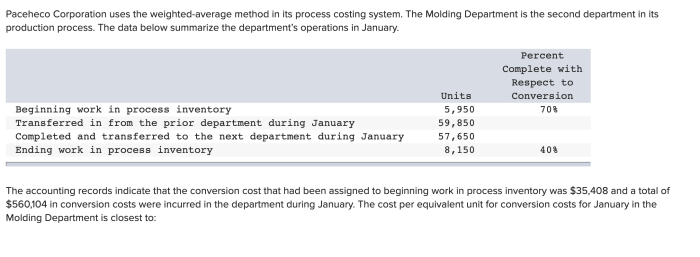

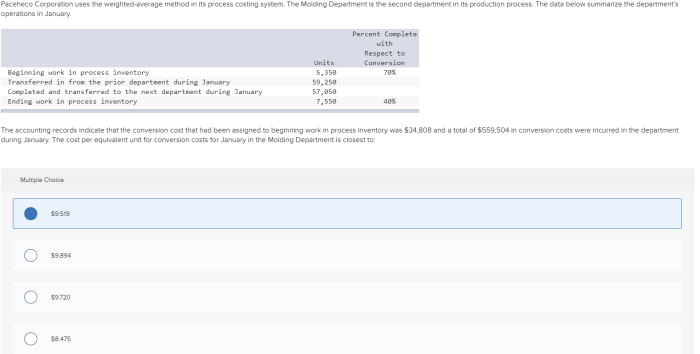

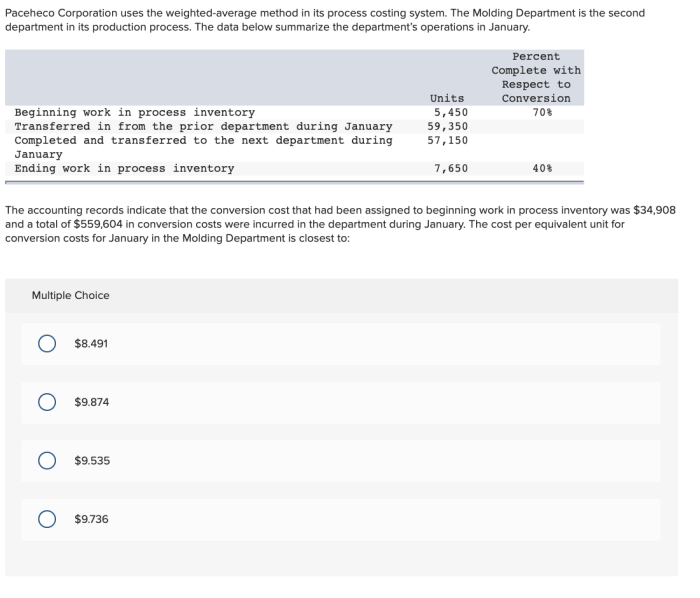

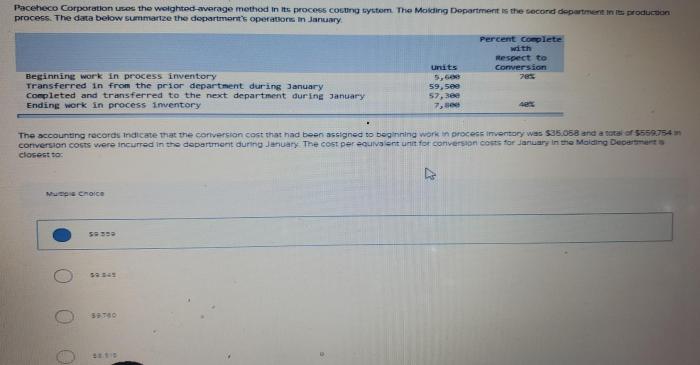

Paceheco corporation uses the weighted-average – Paceheco Corporation employs the weighted-average method for inventory valuation, a technique that offers advantages in managing inventory costs and ensuring accurate financial reporting. This article explores the benefits, challenges, and implications of Paceheco Corporation’s use of the weighted-average method.

The weighted-average method assigns an average cost to inventory items based on their purchase prices and quantities. This method provides a more accurate representation of inventory costs compared to other methods, such as FIFO (first-in, first-out) or LIFO (last-in, first-out).

Introduction

Paceheco Corporation employs the weighted-average method for inventory valuation. This method assigns an average cost to all units of inventory, based on the cost of goods purchased during a specific period. By utilizing this method, Paceheco Corporation can effectively manage its inventory costs and maintain accurate financial records.

Benefits of Using the Weighted-Average Method

Cost Management

The weighted-average method allows Paceheco Corporation to determine an average cost for all inventory items, regardless of when they were purchased. This simplifies cost calculations and provides a consistent basis for inventory valuation.

Inventory Tracking

By assigning an average cost to all inventory items, the weighted-average method enables Paceheco Corporation to track inventory levels and movements more efficiently. This helps in maintaining optimal inventory levels and minimizing stockouts.

Challenges of Using the Weighted-Average Method

Cost Fluctuations

One challenge associated with the weighted-average method is that it can be sensitive to cost fluctuations. When the cost of goods purchased varies significantly, the average cost assigned to inventory items may not accurately reflect the current market value.

Timeliness

The weighted-average method requires periodic updates to reflect changes in inventory costs. This can be time-consuming and may delay the release of financial statements.

Alternatives to the Weighted-Average Method: Paceheco Corporation Uses The Weighted-average

First-In, First-Out (FIFO) Method

The FIFO method assumes that the first goods purchased are the first to be sold. This method can be beneficial when inventory costs are rising, as it results in higher cost of goods sold and lower ending inventory values.

Last-In, First-Out (LIFO) Method

The LIFO method assumes that the last goods purchased are the first to be sold. This method can be advantageous when inventory costs are falling, as it results in lower cost of goods sold and higher ending inventory values.

Impact of the Weighted-Average Method on Paceheco Corporation’s Financial Statements

Income Statement, Paceheco corporation uses the weighted-average

The weighted-average method impacts the income statement by determining the cost of goods sold. A higher average cost assigned to inventory items will result in a higher cost of goods sold and lower net income.

Balance Sheet

The weighted-average method affects the balance sheet by determining the value of ending inventory. A higher average cost assigned to inventory items will result in a higher ending inventory value and higher total assets.

Query Resolution

What is the weighted-average method?

The weighted-average method is an inventory valuation method that assigns an average cost to inventory items based on their purchase prices and quantities.

Why does Paceheco Corporation use the weighted-average method?

Paceheco Corporation uses the weighted-average method because it provides a more accurate representation of inventory costs compared to other methods, such as FIFO or LIFO.

What are the benefits of using the weighted-average method?

The benefits of using the weighted-average method include more accurate inventory records, effective cost management, and compliance with accounting standards.